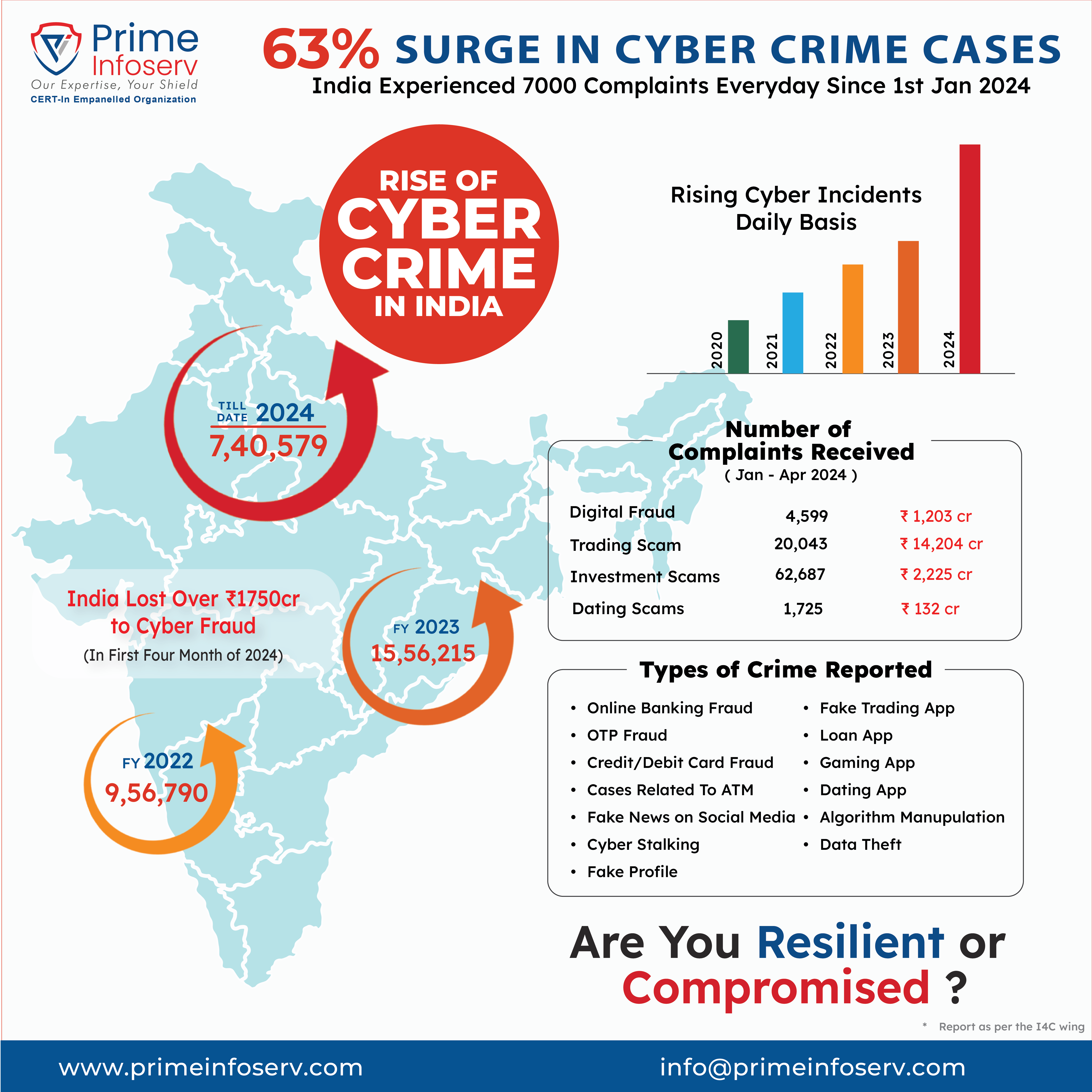

A recent ransomware attack has wreaked havoc on the financial sector in India, affecting over 200 cooperative banks and regional rural banks (RRBs). This incident underscores the growing threat of cybercrime and highlights the urgent need for enhanced cybersecurity measures in the banking industry.

The Incident

The ransomware attack, which began on July 27, 2024, has significantly disrupted banking operations across various states. Reports indicate that between 150 and 200 banks have been impacted, causing widespread chaos for both the banks and their customers. The attackers have encrypted crucial data and are demanding a hefty ransom in exchange for its decryption.

Scope of the Attack

This cyber assault has primarily targeted the IT infrastructure of co-operative and regional rural banks. The affected banks have experienced severe operational disruptions, including the inability to process transactions, access customer data, and perform routine banking activities. The attack has also crippled digital payment systems, leaving many customers unable to complete online transactions.

Impact on Customers

For millions of customers relying on these banks for their financial needs, the ransomware attack has been a major setback. With ATMs and online banking services down, customers have faced significant inconveniences. Many have been unable to withdraw cash, make payments, or access their accounts, leading to frustration and financial stress.

Response and Recovery Efforts

In response to the attack, the affected banks have taken immediate steps to contain the damage and restore normalcy. Cybersecurity experts have been roped in to investigate the breach, identify vulnerabilities, and develop strategies to mitigate future risks. Meanwhile, banks are working tirelessly to restore their systems and ensure that customer data remains secure.

The Reserve Bank of India (RBI) has also stepped in, providing guidance and support to the affected banks. The central bank has emphasized the importance of robust cybersecurity frameworks and has urged all financial institutions to bolster their defenses against such threats.

Lessons Learned

This ransomware attack serves as a stark reminder of the vulnerabilities within the banking sector. It highlights the need for continuous investment in cybersecurity measures and the importance of staying ahead of evolving cyber threats. Banks must adopt a proactive approach, regularly updating their systems, conducting security audits, and training staff to recognize and respond to potential threats.

Conclusion

The recent ransomware attack on over 200 cooperative and regional rural banks in India is a wake-up call for the entire banking industry. As cybercriminals become increasingly sophisticated, the need for robust cybersecurity measures cannot be overstated. It is imperative for banks to prioritize the protection of their IT infrastructure and customer data, ensuring resilience against future cyber threats. By doing so, they can safeguard their operations and maintain the trust and confidence of their customers in an increasingly digital world.

Prime Infoserv, A cert-In Empanelled Organization is your trusted partner in safeguarding financial assets and ensuring robust cybersecurity for cooperative banks and financial institutions. With our cutting-edge solutions and expert team, we provide comprehensive protection against cyber threats, ensuring the integrity and confidentiality of your data. Our tailored services help you stay compliant with regulatory requirements, mitigate risks, and build customer trust.

Connect with our experts at info@primeinfoserv.com or +913340085677.

Follow us on Facebook and Instagram for updates and tips. Your security matters to us!

Stay vigilant and take necessary precautions to safeguard against potential cyberattacks.